How to file a Navy Federal fraud claim and get your money back

So, you’ve glanced at your Navy Federal account and noticed something is off. Maybe there’s a charge you didn’t authorize, an ATM withdrawal from an unknown location, or your balance has significantly dropped. No matter the reason, you’ll want to act quickly: time is of the essence when financial fraud is suspected.

Serving more than 14 million military members, veterans, and their families, Navy Federal Credit Union offers a streamlined process for disputing fraudulent transactions. However, filling a claim requires you to complete a series of steps, and doing so correctly helps you avoid delays.

In this guide, we’ll walk you through how to determine whether you’re eligible for reimbursement, how to file a fraud claim step by step, and what to do next.

Navy Federal’s fraud protection policy

As a Navy Federal customer, you are protected under its zero-liability policy. That means you’re protected in the case of stolen credit card details, fraudulent ATM withdrawals, and unauthorized online or in-store transactions. In other words, you can count on reimbursement for any transaction you did not authorize.

However, don’t expect reimbursement if you were tricked into sending money voluntarily, which often happens through phishing/vishing scams, fake investment schemes, wire fraud, and gift card scams. To give you an example, if you buy a product online and the product never arrives, Navy Federal won’t reimburse you for the cost.

Another thing to be careful about is timing: you must report the unauthorized transaction as soon as you notice it. If you fail to report it within 60 days of the statement date, you will lose your right to reimbursement.

Difference between fraud and scam

In everyday speech, “fraud” and “scam” are often used interchangeably, but there’s a subtle yet important difference between them. Understanding this distinction can help you determine whether your bank balance issue is covered by Navy Federal’s zero-liability policy.

Simply put, victims of fraud have a chance of recovering their money, while victims of a scam, unfortunately, are not eligible for a refund. Here’s why.

Fraud is any type of unauthorized transaction made without your explicit consent or knowledge. For example, someone can steal your credit card details, hack your account, or steal your identity. This allows the malicious actor to make purchases or withdrawals without your consent.

A scam, on the other hand, happens when someone manipulates you into authorizing a payment. Since you technically approved the transaction (even under false pretenses), reimbursement is unlikely. For example, you could unknowingly purchase something via a fake shopping site and never receive the goods you paid for.

Types of fraud covered by Navy Federal

Navy Federal protects its members from various types of fraud, offering a distinct procedure for each fraud type.

Identity theft and account takeover

Identity theft happens when a fraudster collects enough personal information to drain your funds. In most cases, this could be your Social Security number, Navy Federal account details, or your online account/app credentials.

Some early signs of identity theft or account takeover include alerts of account changes you didn’t make, like changing your password, phone number, or email address. If that happens, contacting Navy Federal as soon as possible is crucial to prevent further financial damage.

Navy Federal protects you from account takeover by offering multi-factor authentication, which we highly recommend using.

Credit card fraud

There are several ways someone might obtain your credit card information. This can happen if your credit card is stolen or cloned (usually done using credit card cloning machines hidden in ATMs).

Furthermore, your credit card information might leak in a data breach. Using that information, a fraudster can make purchases without your authorization. These are usually small purchases at first, which is how scammers test the waters.

The easiest way to spot credit card fraud is to check your transaction history for irregularities, such as purchases you don’t recognize.

To protect you from credit card fraud, Navy Federal has a freeze feature, allowing you to freeze your payment card using the Navy Federal app. It also uses Europay, Mastercard, and Visa (EMV) chip technology. Unlike traditional magnetic stripe cards, which store static card data that can be easily copied by skimmers, EMV chips generate a unique transaction code for each purchase, making it much harder for criminals to clone the card or use stolen data.

Loan and mortgage fraud

This type of fraud usually involves large sums. It happens when someone applies for a loan or mortgage using your stolen personal details.

Identifying loan or mortgage fraud is difficult, so pay close attention to any unexpected credit inquiries on your credit report. If you notice a hard inquiry from Navy Federal that you didn’t authorize, this is a red flag.

In that case, notify Navy Federal immediately and consider placing a fraud alert or freezing your credit with the three major credit bureaus: Experian, Equifax, and TransUnion.

To request a fraud alert, you only need to contact one of the bureaus; they are required to notify the other two. However, if you want to freeze your credit, you must contact each bureau individually.

How to file a Navy Federal fraud claim (step-by-step-guide)

Now, it’s time to discuss how to file a Navy Federal fraud claim, from gathering the required documentation to contacting the credit union. You’ll want to act quickly and strategically, so here’s our step-by-step guide.

Step 1: Identify the fraudulent transaction

Review your account statements and transaction history to confirm unauthorized activity. Make a note of the date, amount, and merchant name for each suspicious transaction.

Step 2: Lock your card (if applicable)

If your debit or credit card has been compromised, temporarily lock it using the Navy Federal mobile app or online banking to prevent further unauthorized charges.

Step 3: Contact Navy Federal’s fraud department by dialing 1-888-842-6328

After preparing all the information you need, it’s time to report the fraud to Navy Federal. The sooner you act, the better your chances of avoiding further losses.

Navy Federal fraud claim phone number and online reporting

The fastest way to contact Navy Federal’s fraud department is to call 1-888-842-6328. The support team is available 24/7.

If you’re currently abroad, you can use a Voice over Internet Protocol (VoIP) app, such as WhatsApp, to call 1-888-842-6328 from your phone or computer. There are also specific phone numbers if you’re reporting a fraud from one of these countries: Australia, Germany, Italy, Japan, Korea, Malaysia, New Zealand, the Philippines, Singapore, Spain, Taiwan, and the United Kingdom.

In the case of unauthorized or inaccurate transactions, you can also file a report online. You will be prompted to log into your account and then taken to Navy Federal’s online system for reporting fraud. This is also the easiest way to submit your evidence.

Best times to call and expected wait times

Generally, it’s best to contact Navy Federal as soon as you notice anything strange. That said, Navy Federal’s fraud department can experience high call volumes after weekends or major fraud incidents.

If you wish to reduce wait times, it’s best to call early in the morning (8 am to 10 am). Longer wait times usually happen on Mondays and during lunch hours (12 pm to 2 pm).

Step 4: Follow up on your claim status

You can expect Navy Federal to send you regular updates regarding your claim via email or mail. That said, checking your claim status is always wise to ensure it’s processed correctly.

You can see updates on your claim by logging into your Navy Federal account. You can also call 1-888-842-6328 to ask about your case.

How long does it take to get your money back?

Payment card frauds are resolved within 90 days.

As per Navy Federal’s policies, you may receive a provisional credit if investigating your claim is expected to take longer than 10 business days. That means you might temporarily get the disputed amount back while the investigation is ongoing. If the investigation confirms the fraud, the provisional credit becomes permanent. Otherwise, the credit may be reversed, and the disputed charge will be reposted to your account; you’ll then be responsible for repayment.

It’s crucial to report fraud as soon as possible. The sooner you alert Navy Federal, the higher the chances they may be able to stop or reverse a fraudulent transaction.

What to do if your claim is denied?

Remember that you’re not out of options if your claim is denied. The first step is to review the reason for the denial, which will give you a clue about what to do next.

If there’s insufficient evidence to prove fraud, you could gather additional supporting documentation. That can include screenshots of fraudulent emails and texts, a police report, or statements showing unauthorized activity.

If you believe the denial was unfair, contact Navy Federal and ask to speak with a fraud specialist. Alternatively, you can file a complaint with the Consumer Financial Protection Bureau (CFPB) or the National Credit Union Administration (NCUA).

How to spot a Navy Federal scam before it’s too late

As discussed above, unlike fraud, a scam involves you authorizing a transaction. Unfortunately, for this reason, victims of a Navy Federal scam are not covered by the zero-liability policy. That makes learning how to recognize a scam even more important.

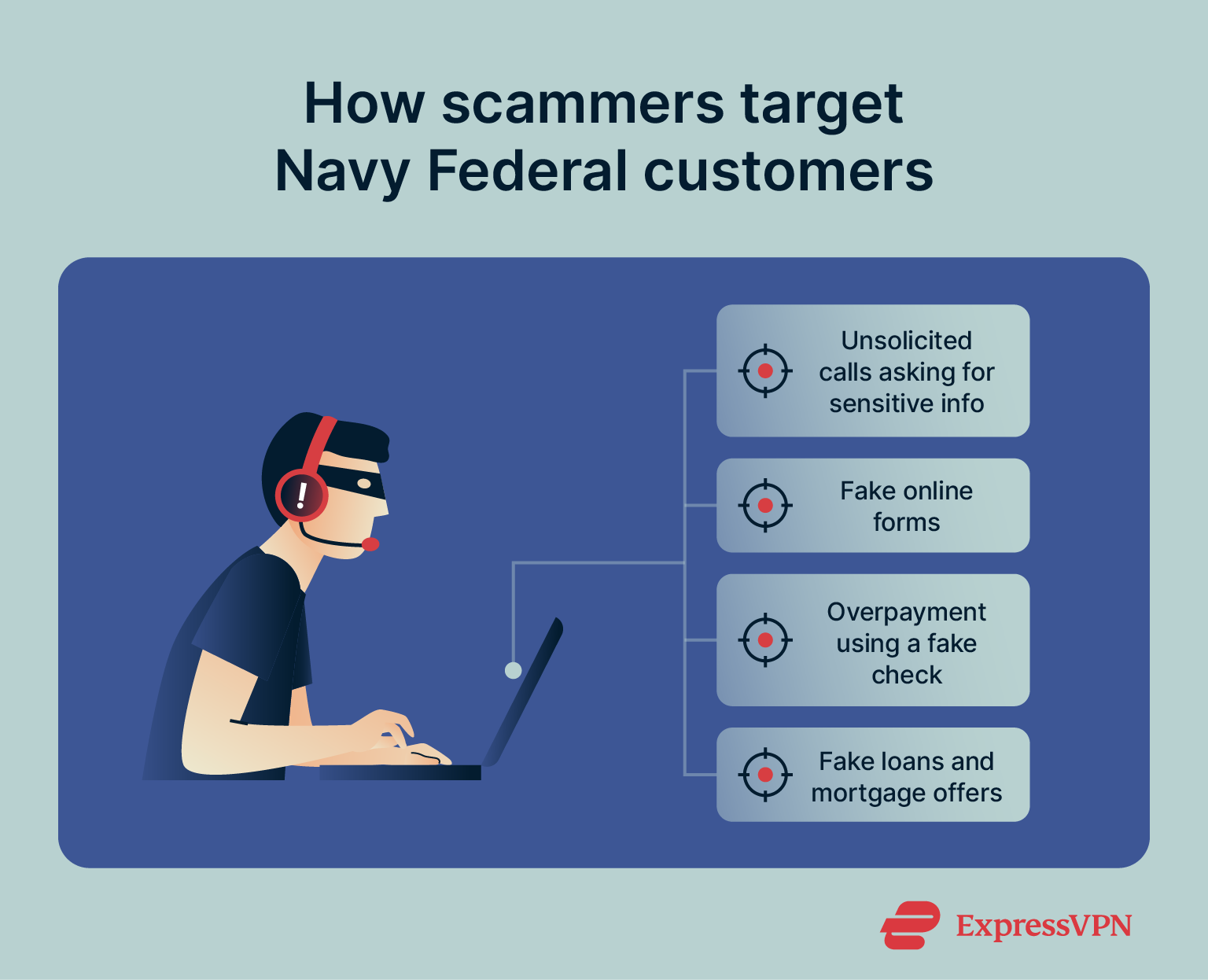

Even though financial scams constantly evolve to adapt to new banking trends, their core concept rarely changes. In most cases, scammers create a feeling of urgency that pressures you to act impulsively. Here are some of the most common ways scammers target Navy Federal customers:

Here are some of the most common ways scammers target Navy Federal customers:

- Unsolicited calls asking for sensitive information: Scammers usually call or send messages about a potential freeze of your funds unless you verify your details. Or they notify you of an unusual login, asking you to confirm your password. Sometimes, scammers even use phone spoofing techniques to make their caller ID appear legitimate. But real Navy Federal employees will never call or text you to inquire about your personal information, such as your bank account number, email address, or payment card PIN number. That information is confidential and should never be revealed over the phone or in a text.

- Online forms asking for your information: It doesn’t have to be a call or a text message either; phishing scams trick you into clicking a malicious link (usually in an email), taking you to a fake version of Navy Federal’s site. That’s why it’s crucial to double-check the website’s URL. It should start with “navyfederal.org,” which is the official address of the credit union’s site.

- Overpayment using a fake check: It’s not uncommon for fraudsters to send a bogus check and then ask you to return part of the money. If you decide to do so and the check bounces later, you’ll lose the funds. Since this is a scam where you intentionally send money, Navy Federal won’t reimburse you.

- Fake loans and mortgage offers: Getting a guaranteed loan approval with no credit check sounds too good to be true, and it is. Fraudsters can offer you hard-to-refuse loans that come with upfront fees. Needless to say, you’ll lose any money you pay for a nonexistent loan without a chance of getting a reimbursement.

How to protect yourself from Navy Federal fraud and scams in the future?

Even though Navy Federal provides automated protection against certain types of fraud discussed above, it's ultimately your responsibility to stay vigilant and recognize financial fraud and scams before they impact you. Even if you’re eligible for reimbursement, it’s best to avoid the situation altogether. So, let’s go over some of the most effective ways to protect yourself.

Use two-factor authentication (2FA) and secure passwords

2FA is a security measure that requires you to verify your identity by entering a one-time security code when logging into your Navy Federal account. This helps keep your account secure, even if someone knows your password.

Enabling 2FA takes just a few moments, and it’s done through the Navy Federal mobile app the first time you sign in. You’ll have the option to receive a one-time code via text message or email. You can also choose to remember your device for future logins, after which you can use Face ID, Touch ID, or a 4-digit passcode.

It’s also important to use a strong, unique password for your account. That way, even if someone gains access to your phone, email, or texts, they’ll still need to crack a complex password to access your banking app. For added security, make sure your phone is protected with a strong PIN or biometric lock and consider enabling remote wipe in case it’s lost or stolen.

I recommend using a unique password for each of your online accounts. Strong passwords typically have 12+ characters and mix uppercase, lowercase, numbers, and symbols. A password manager like the one included with each ExpressVPN subscription can automate the process of generating and filling out strong passwords.

Use an antivirus with phishing protection

A capable antivirus can be an ultra-powerful ally in preventing malware, phishing, and other digital threats. For example, antivirus apps can flag phishing emails, prevent you from visiting malicious websites (such as a fake Navy Federal site), and detect Trojan malware (keyloggers or banking Trojans).

Secure your online security with a VPN

A reliable VPN like ExpressVPN can make a huge difference in increasing your online security.

If you’re logging into your bank account or shopping online while connected to a public network, using a trusted VPN is essential. Public Wi-Fi networks typically lack proper encryption, which means hackers can easily intercept your internet traffic and steal sensitive information like payment details.

ExpressVPN also offers Advanced Protection across all its supported platforms, using DNS-based blockers to avoid ads, trackers, and malicious sites, helping reduce your exposure to phishing scams and other online threats.

FAQ: Common questions about Navy Federal fraud

What is a Navy Federal fraud claim?

How do I file a fraud claim with Navy Federal?

How long do I have to report fraud to Navy Federal?

What should I do if I suspect fraud but haven’t lost money yet?

Can I dispute a fraudulent transaction online?

How do I know if my fraud claim is being processed?

Will Navy Federal refund me if scammed?

How long does a Navy Federal fraud investigation take?

How do I contact a legitimate Navy Federal representative?

Why am I getting emails from Navy Federal Credit Union?

How do you know if you met a scammer?

If you suspect someone is a scammer, avoid engaging with them, do not share any personal information, and report the scam to the appropriate authorities.

Take the first step to protect yourself online. Try ExpressVPN risk-free.

Get ExpressVPN